Find Your Startup Company Investors With Funding Foreplay

Helping You Properly Prepare for Romancing Startup Company Investors

Then Helping You Find All The Right Angel Investors For Your Company

Even though I have a network of 4K++ angel investors and 2.5K VC (all of whom personally know me), I am not a direct angel investor myself. Instead, I help my clients make sure they are genuinely “Ready for Prime Time” for their fundraising – and THEN help get them connected with startup company investors in my network.

As someone who has personally raised over $110 million in today’s dollars from 1,342 Angel Investors and Venture Capitalists for my own companies, I understand the overwhelming fundraising challenge that you face in today’s economic environment.

One of my primary services is cost-effectively mentoring and guiding startup company CEOs like yourself through the confusing and complicated, totally treacherous, jungle of raising investor capital – and helping them to accelerate their fundraising success.

If you intend to raise funds for your startup company, you will find my Funding Foreplay Service to be one of the most helpful, pivotal and beneficial decisions you can make in the long, complex and complicated process of finding and closing startup company investors.

Whether we work together or not, here are four mission-critical key questions that you should ask yourself:

- How, EXACTLY, are you going to find AND successfully entice each and every Angel investor you need for your startup company?

- No arm waving. No sweeping generalizations. No illegal success fees. How EXACTLY will you get it done?

- What are your top three dozen fundraising action items? “WHO? Is going to do WHAT? WHEN?” for each of these action items on your fundraising game plan?

- Will all of the “When” be in time for your company’s ticking time bomb cash flow needs?

For many clients, being genuinely Ready for Prime Time has made the difference between success and failure with their fundraising.

My Funding Foreplay Service is designed to specifically help startup company CEOs be genuinely Ready for Prime Time for their fundraising and to also be properly coached to romance investors the right way.

All of this usually means that I have to keep many of my clients from screwing up the romance of their business life with some, or all, of these Top Dirty Dozen Deficits:

- Bad strategies with incorrect objectives.

- Ineffective tactics for execution.

- Nonexistent action planning for milestones and resources.

- Arm-waving sales and marketing planning.

- Incomplete, business planning without proper investor focus.

- Unbelievable, unrealistic, unachievable financial projections.

- Illegal, incomplete offering documents and blue sky compliance.

- Missing state and federal filings required by securities laws.

- Boring pitch decks not properly focused on the investor and their ROI from a fair equity split valuation.

- Missing exit plans that show investors how they get their return of capital.

- Illegitimate or missing password-protected investor website.

- Missing or incomplete game plan for actually raising the investor funding.

These Dirty Dozen Deficits are just some of the multitude of issues that can be turnoffs to prospective startup company investors which in turn can kill your offering – and your company’s future.

My Funding Foreplay Service is specifically focused on a complete review, and fixing if necessary, each of the above dozen issues, and more, to make sure that your company is actually fundable – and that everything for your fundraising is genuinely Ready for Prime Time – BEFORE you pitch even the first prospective investor.

It’s a fact: When it comes to fundraising, there are absolutely no guarantees. If someone tells you they can guarantee that your fundraising will be successful, they are almost certainly lying to you.

Because of this, you do not want to waste even a single prospective investor opportunity by screwing up even one of the above issues.

You have got to get it right the first time and every time. This is not the time for A/B testing.

Shark Tank: It’s Embarrassing to Watch So Many Unprepared Startup CEOs

Stumble So Badly

My wife loves to watch Shark Tank. Absolutely loves it. For me, the show is too hard to watch since so many startup company CEOs screw up their investment pitch so badly.

During the past three decades, I have worked with thousands of startup companies so I understand what it’s like to be an entrepreneur and put your whole heart and soul into your company – only to watch it crash and burn because you cannot successfully raise the funding to achieve your vision

I get that Shark Tank is Reality TV and that bumbling founders who look like buffoons probably increase ratings.

One thing the show does highlight is this: Most startup company CEOs are completely clueless and unprepared to pitch their investment opportunity for their company.

Here are my Top 10 Shark Tank Mistakes:

- They don’t know their numbers – or their implications;

- They don’t understand their own sales and marketing requirements and what it takes to actually close the sale and get wallet share;

- They don’t understand how to produce and market their own Minimum Viable Product (MVP) to gain traction;

- They don’t know how to create realistic, believable, achievable driving assumptions for their financial projections to have any credibility;

- They don’t understand the components of valuation or how much X% of the company has to be exchanged for the $Y needed;

- They are clueless as to the step-by-step actions required for genuine implementation – including all the Deviled Details of marketing, advertising, personnel and operating costs ;

The Cuban Head Shake

- They don’t understand that a concept, by itself, that has not been executed is pretty much worth zero;

- They don’t understand, whatsoever, what it takes to properly pitch the deal so that it’s meaningful to prospective investors and motivates them to stroke the check;

- They don’t understand the legal constraints when it comes to fundraising and end up breaking the law by violating state and federal securities laws;

- They don’t know that sweeping generalities and stumbling, arm-waving answers to any or all of the above issues will only destroy any credibility they might have gained.

These are some of the very reasons that I offer my Funding Foreplay Service – so that my clients don’t embarrass themselves by making those same mistakes in front of their own prospects for their own fundraising.

If you’re honest with yourself, how many of the above issues are going to be critically pivotal problems for your fundraising?

The good news is that I help my clients be fully prepared for all of the above issues by teaching and implementing the right foreplay for the offering – before they start romancing their prospects.

The Courtship Ritual for Startup Company Investors

You wouldn’t walk up to a complete stranger and ask them to marry you. You already know that there’s a courting process, a general sequence of events, a ritual, required even for love.

The same is true with prospective startup company investors. Are you really going to ask prospective investors to marry you by investing in your company – even before the first kiss?

If you don’t learn the language of investor love, your first contact will probably never get their attention and you won’t even get to the first kiss – let alone the consummation of them stroking a check to invest in your company. All you will get is yet another rejection.

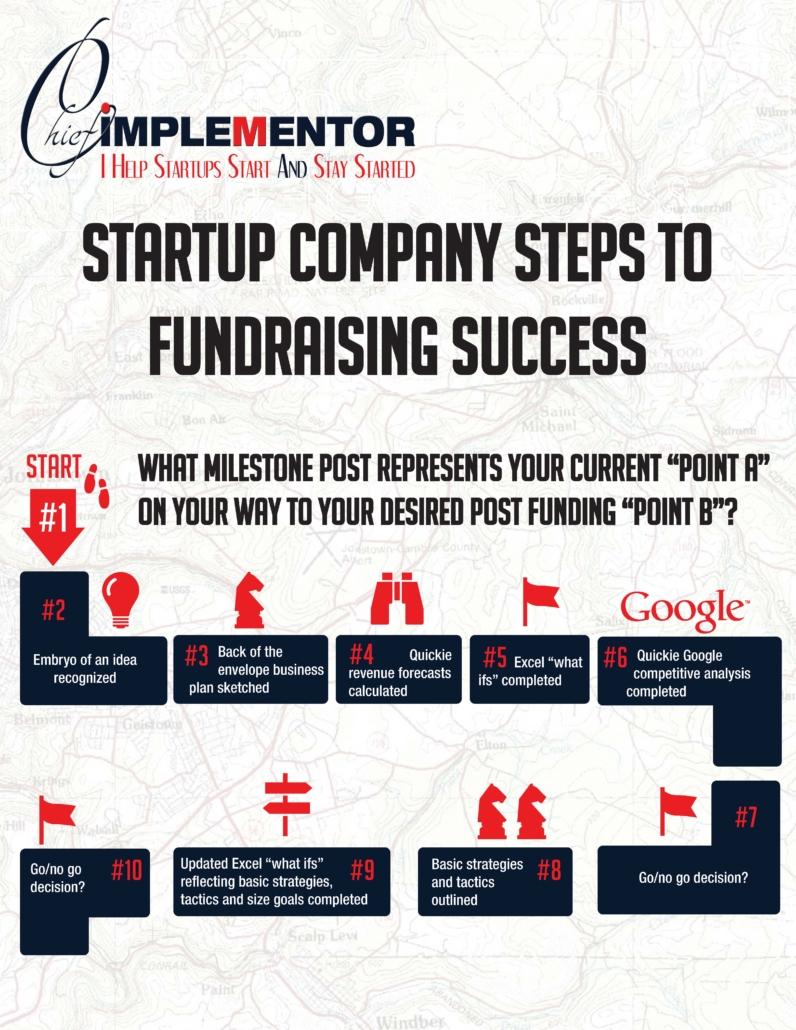

Do You Know ALL 53 Steps That Are Necessary to Start a Startup AND Be Ready to Successfully Raise Capital from Angel Investors?

Click This Image to Download Your Own Free Copy of This PDF!

Startups almost always only get one chance with a prospective investor. The prospect expects to be approached and romanced in a certain way, with the right documentation and the right sequence of steps.

The fact is that many startup companies are frankly clueless when it comes to raising funds from investors. That part is not surprising. Most startup company CEOs are fundraising virgins.

Fundraising is both highly complex and complicated – and you have to do every step the right way to be successful.

(To understand some of the complex and complicated issues involved, please click on the “Startup Company Steps to Fundraising Success” graphic to get your free copy of this helpful PDF.)

Even when the startup company has some understanding of the complicated process, they blow their chances with what few prospective investors they can find – by not romancing the prospect the right way for the startup company to have any credibility.

With my Funding Foreplay Service, I personally work with startup companies so that they learn the language of investor love and learn what they have to change so that they are genuinely Ready for Prime Time.

All of this greatly increases my client’s chances for the successful romance of angel investors to invest in their company.

How I Learned the Language of Startup Company Investor Love

For the past 30 years, I have focused solely on helping startup and emerging companies with their business planning, funding foreplay, fundraising, implementation and mentoring of the CEO and other senior executives.

During that time, I’ve already directly helped THOUSANDS of diverse startup companies and their CEOs, in 49 of the 50 states, in over 70 countries, on six of the seven continents and in more than 200 different industries.

As background, I successfully completed all 44 of my Reg D offerings personally raising $110 million in today’s dollars from 1,342 Angel Investors and Venture Capitalists with over $322 million – Nearly 1/3 of $1 billion – in today’s dollars of income property transactions, managing over 45,000 rental units (45,000 units in today’s rental units!) and became the 7th largest operator of self-storage facilities in the Nation. I even started my own NASD broker-dealer company..

To find those 1,342 investors, I had to romance tens of thousands of additional prospective investors who said “No.”

On many of those pitches, I totally crashed and burned! Talk about rejection!

But I also learned from the burn – and I got smarter with each “Yes” AND each rejection.

During all that time I’ve learned a whole lot about investor mindsets, expectations and what is required for a successful romance with prospective investors.

It’s all that experience – from all that romancing of investors who invested with me – and also from romancing the tens of thousands of startup company investors who did not invest – that helped me learn the language of investor love.

Additionally, I was the Founder, CEO and Chairman of Goodman Securities, Inc., a direct participation broker-dealer and member of the National Association of Securities Dealers, Inc. (NASD) and the Securities Investor Protection Corp (SIPC).

As a result, as a non-attorney, I became keenly aware of state and federal laws and how they may impact your offering – and your romancing of startup company investors – and some of the business steps you may need to take to legally comply with these laws without getting tripped up by the near infinite technicalities of both the romance and seduction of potential investors.

All of that combined experience is what I share with my clients through my Funding Foreplay Service.

How the Funding Foreplay Process Works

I work with many of my clients on their Funding Foreplay to help make sure that they are fully prepared for both the romance of prospective investors for their deal – and the final required steps to motivate some of those prospective investors to stroke the investment check.

Hint: The Funding Foreplay process is absolutely required before you start romancing even your first prospective investor.

My Funding Foreplay Service usually includes some, or all, of the following – depending on each client’s specific needs:

- I usually start with a review and audit of your current company strategies, tactics, action plans, sales and marketing plans, business plans and offering documents.

- I help identify which of the above dirty dozen deficits, along with other issues, are potential problem areas for your offering.

- At this point, my clients can choose to fix the deficits themselves, have me fix some, or all, of them – or have me oversee and manage the fixes.

- I sometimes help make sure my clients have well-thought-out strategies, tactics and action plans for implementation (this is a major item that is most often overlooked by entrepreneurs.)

- I sometimes work with clients to crystallize their sales and marketing plans so they are realistic, achievable and believable – and reflect the kind of growth investors expect to see.

- I sometimes work with clients so they can properly complete their business planning – including making sure that they have used realistic, achievable and believable driving assumptions for their financial projections.

- Sometimes, I help clients and their attorneys with their offering documents so that they comply with both state and federal securities laws – while still properly reflecting the sizzle parts of the business plan.

- Often, I help my clients cost-effectively draft for legal review the right kind of Reg D private placement memorandum that complies with the new JOBS Act for crowdfunding. This is the mandatory document that you are legally required to produce which will also let you legally advertise your company’s investor offering. (Note: without properly completing the specific kind of private placement needed for public advertising, you’ll almost certainly be violating state and federal securities laws!)

- Sometimes, I help clients find investors willing to stroke a check to invest in my client’s company.1

- Sometimes, I do all of the above – and more.

My goal is to make sure that all of these steps along with several other documents, and my client’s investment pitch, are correctly done with everything genuinely ready for “prime time.”

My business model is precisely the same as most successful attorneys: I work against a prepaid retainer that is refreshed as long as the client continues to want to work with me. My services are available on an hourly basis at my Standard rate of $150 per hour. We can get started with a ten-hour initial retainer of only $1,500.

Simple. Direct. Legal. Very affordable. No long-term commitment. Highly cost-effective for action-oriented startup companies.

How Many Hours of My Consulting Will You Need?

This depends on a multitude of issues such as: what’s already been done; is what you have already done good enough “as is” to motivate prospective investors; do I do everything or do you and your team do some or most of the heavy lifting; etc.?

Based on my three decades of doing this, my experience with a multitude of clients is that even just 10-20 hours of my help, while far from totally comprehensive, can be pivotal for a large majority of the mission-critical fundraising situations that come across my digital inbox.

At a minimum, many of my clients have found this 10-20 hour approach is an excellent way to have their offering “audited” by someone who has reviewed several thousand other offerings over the past 30 years.

Often, I find flagrant oversights and major errors that are easily fixed but that would’ve been deal killers if presented to prospective investors. Many of these problems relate to the five-year financial projections that prospective investors would find unbelievable and unachievable – or even laughable.

Prospective investors are rare and you typically only have one shot at motivating them to stroke the check to invest in your company. Don’t chance wasting even one prospect because of the above embarrassing errors and omissions that could kill your mission-critical investment offering.

My goal is to do all that I can to help get my clients to their Post-Funding Point B as fast as possible.

Once I’ve completed my audit of your offering and underlying documents, I then work with you to develop a fundraising action plan to make sure that you are genuinely “Ready for Prime Time.”

This means that everything is been checked, all documents are complete and consistent, the investor website has been finished – and we are finally ready to start pitching our offering to prospective investors.

Help Finding Your Startup Company Investors

“How helpful would it be to you and your company if I were to personally send out your complete pitch deck, video, or other fundraising document, prefaced with my cover letter summarizing your offering, to ALL of my 4,000++ Angel Investors AND 2,500+ VC – ALL of whom personally know me – with it delivered to all of them at the same time – as fast as the next 72 hours?”

Once I have worked with you and your company through my Funding Foreplay Service to help you prepare for your fundraising and I fully understand your business model, management team, financials, etc., I am then prepared to recommend your offering and I can then contact, at my standard hourly rate, an appropriate subset of my network of several thousand angel investors about your investment offering.

That way, my Angel network knows that I’ve already completed my usual, significant due diligence on your company before bringing your company’s deal to them – which is a Win-Win situation for everyone!

The first step is to make sure that you are fundable AND that your offering is genuinely ready for “prime time” with my Funding Foreplay Service.

If you are already “Ready For Prime Time,” check out my Fast Angel Pitch Service video tutorial:

Help for Your Fundraising

Ask yourself:

- How much of your Funding Foreplay have you already completed the right way – and if your current offering is genuinely Ready for Prime Time?

- How many of those dirty dozen mistakes that were listed above are still problem areas for your company and your fundraising?

- Can your current Quest for startup company investors benefit from some of my Funding Foreplay Services to help increase your probability of a successful romance?

You know you have competitors for your new company.

But you need to understand that you also have funding competitors –other startup companies competing for the very limited attention, time and money from the same prospective startup company investors.

This is your chance to rise above the noise and your investment competitors and have your Funding Foreplay done the right way with your documents written in the right language – the language of investor love.

So, what WILL it take to motivate startup company investors to write YOU a check for your new company?

Find out with my Funding Foreplay Service.

Finally, you have a totally unique, very cost-effective, one-of-a-kind solution to knowing what it takes for you to really be ready to romance and consummate the deal with startup company investors.

With Funding Foreplay, you won’t be embarrassed by novice and clueless fundraising attempts – you will be ready for all the questions that prospective lenders or startup company investors may ask about you and your investment offering.

Questions Or Ready To Move Forward?

Contact me today to discuss how I can best help your startup start and stay started!

Be GREAT!

Robert

Robert Lee Goodman, MBA

CEO and Chief ImpleMentor

CEO RESOURCE LLC

FastAngelPitch.com

AngelAudits.com

FractionalSyndicator.com

RealEstateImpleMentor.com

StartupCompanyInvestors.com

StartupCompanyStepsToFundraisingSuccess.com

ChiefImpleMentor.com

———————————————————–

My 23K+ 1st Level Connection LinkedIn Profile: Linkedin.com/in/robertleegoodman

Elevator Pitch: “I Help Startups Start and Stay Started With My Services – And My Direct Network Of 4K++ Angel Investors AND 2.5K+ VC – All of Whom Know Me.”

PS: If you would like to see what my prior clients have to say about me and my services, please check out this link:

1 Contingent Finder’s Fees

You need to know that you cannot pay contingent finder’s fees or success fees…to me or to just about anyone.

Paying contingent finder’s fees or success fees are violations of both state and federal securities laws – and both you and I could have a very serious problem with legal action, very hefty fines and penalties… And even jail.

I don’t know about you but I don’t want to end up in Martha Stewart’s old jail cell that was her required residence as a result of her felony conviction!

Be sure and check out SuccessFees.com for details on this before you try to raise your first investment dollar!