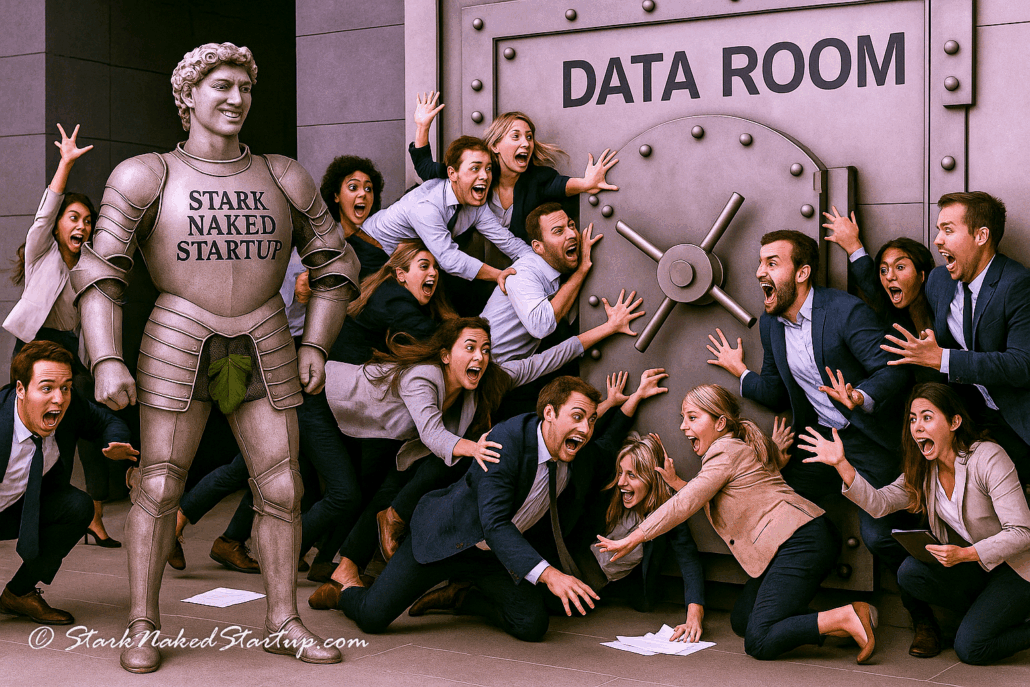

Stark Naked Startup – The Service

Your Fig Leaf Won’t Survive Investor Due Diligence. Armor Up.

Stark Naked Startup™: Because You Can’t Fake It Till You Fund It.

You wouldn’t walk into a boardroom stark naked.

So why are you about to pitch investors with just a fig leaf and a heavily flawed pitch deck?

According to a 10-year study by the Kauffman Foundation in Kansas City, 94% of startups fail to receive funding from angel investors.

And honestly? Most of them deserved it.

Not because their ideas were bad. But because they showed up unprepared, uninformed, and basically… unclothed. No financials. No legal docs. No plan. Just vibes – and a half-ass game plan for implementation.

Stark Naked Startup – The Service is your no-nonsense, no-fluff, fig-leaf-replacing strategy to finally get investor-ready — or at the very least, reality-ready.

Whether you’re actively raising capital or just trying to survive long enough to matter, we’ll walk you through the 10 documents that smart founders actually need.

Because it turns out… fake confidence isn’t clothing.

The Fig Leaf Isn’t Enough

You Need 10 Critical Investor-Centric Documents Done Right to Replace Your Indefensible Fig Leaf Attempt At Investor Facing Documents

Each one of these 10 critical documents covers you in ways the others can’t. Together? They build your full fundraising armor. Separately? They at least help you not go broke next quarter.

Here’s what every serious founder needs:

1. The Ready for Prime Time Action Plan

Your master checklist. 100+ Action Steps that move you from wherever you are to truly investor-ready. This isn’t a business plan. It’s a get-funded plan.

This Action Plan isn’t just a task list. It’s the operational blueprint that maps your journey from “great idea” to “great pitch.” It clarifies where you are, what’s missing, and what absolutely must get done before you try to convince anyone to write you a check. We cover the granular (like syncing financials with your pitch narrative), the strategic (choosing the right SEC exemption), and the sanity-saving (deadlines, milestones, internal checkpoints). Think of it as your business’s version of Google Maps — but for funding. Except this one also helps you avoid regulatory landmines, due diligence failures, and death-by-spreadsheet. Most founders dramatically overestimate their readiness. This plan recalibrates that belief. Better to discover your gaps now than in front of a room of investors holding pens that never click.

2. Investor-Focused Business Plan

Not the Stark Naked Startup, heavily flawed Fig Leaf version. Not the 100-page MBA version. This is a lean, sharp, investor-specific story that answers the only question that matters: “Why should I give you money instead of someone else?”

Too many startup business plans read like bad romance novels: long-winded, full of dreams, and totally disconnected from reality. This plan is different. It’s written for one person: a skeptical investor deciding if you’re worth their time and money. That means clear market sizing, believable growth models, precise monetization, and a competitive moat you can defend. It strips out the academic fluff and focuses entirely on the investability of your venture. What pain do you solve? How big is the opportunity? Why are YOU the team to pull this off? And how does this all turn into a return on their investment? If your business plan can’t answer those questions, it’s not a business plan. It’s a brochure that will never get you funded.

And, let’s not overlook one of the most often forgotten parts: discussing the “Business Of The Business.” This part convinces prospective investors that you know what it takes to run the business as the CEO. It convinces investors that you can take all of that raise and actually implement a business that can profitably drive revenues to meet or exceed the financial projections you show them. Fail this part, and you will fail to get your funding.

3. Financial Projections That Don’t Get You Laughed Out of the Room

This is where 94% of founders go completely stark naked. Losing even the fig leaf.

We’ll help you build believable, GAAP-compliant, investor-grade 5-year projections based on realistic and believable driving assumptions you actually understand and explain. Because if you can’t defend your numbers, they’re not numbers — they’re fiction.

Investor capital doesn’t fund ideas. It funds outcomes. And those outcomes are measured in numbers. But most founders treat projections like creative writing — imagining massive growth with no logic behind it. In this section, we dig into unit economics, gross margins, CAC, LTV, and realistic runway projections. We teach you how to model your business like someone who knows what a balance sheet is. More importantly, we train you to speak the numbers out loud. You’ll know how to justify your revenue curve, explain your hiring assumptions, and defend your fundraising ask with confidence. We also help ensure that you understand the key metrics of the “Business of the Business” and all the pivot points that can make or break the company as you manage it to success. Because when investors say, “Walk me through your projections,” they’re not testing your math. They’re testing your grip on reality.

4. Executive Summary

A bridge between your pitch deck and business plan. Think of it as the verbal handshake investors get before they decide if you’re worth their time.

Your executive summary is not a paragraph. It’s not a quote. It’s not a mission statement. It’s the eight-page distillation of your entire startup into a compelling, logical, and exciting story. It must be concise, direct, and clear enough that an investor could read it in under 5 minutes and want a meeting. You’ll learn how to highlight your traction, team, TAM, SAM, SOM, timing, and technology without sounding like a cliché generator. This is where we help you ditch the vague buzzwords and present your opportunity like a pro. Done well, your executive summary is what earns you a real conversation — or instantly lands you in the “maybe later” pile.

5. One-Pager

The most overlooked weapon in your investor toolkit. This is your startup’s dating profile — it needs to turn heads, not raise eyebrows. This makes all the difference as to whether they swipe left or swipe right.

Imagine a VC clicks on your Calendly link. They’re between meetings. You have one shot. This is your one-pager’s moment. It needs to say who you are, what you do, why it matters, how you make money, what your traction looks like, how much you’re able to scale over five years, how much you’re raising, and what the investor gets — all in one clean, scannable sheet. Done right, your one-pager becomes the weapon your champions forward to other investors on your behalf. We help you design one that’s visually sharp, logically structured, and irresistibly shareable.

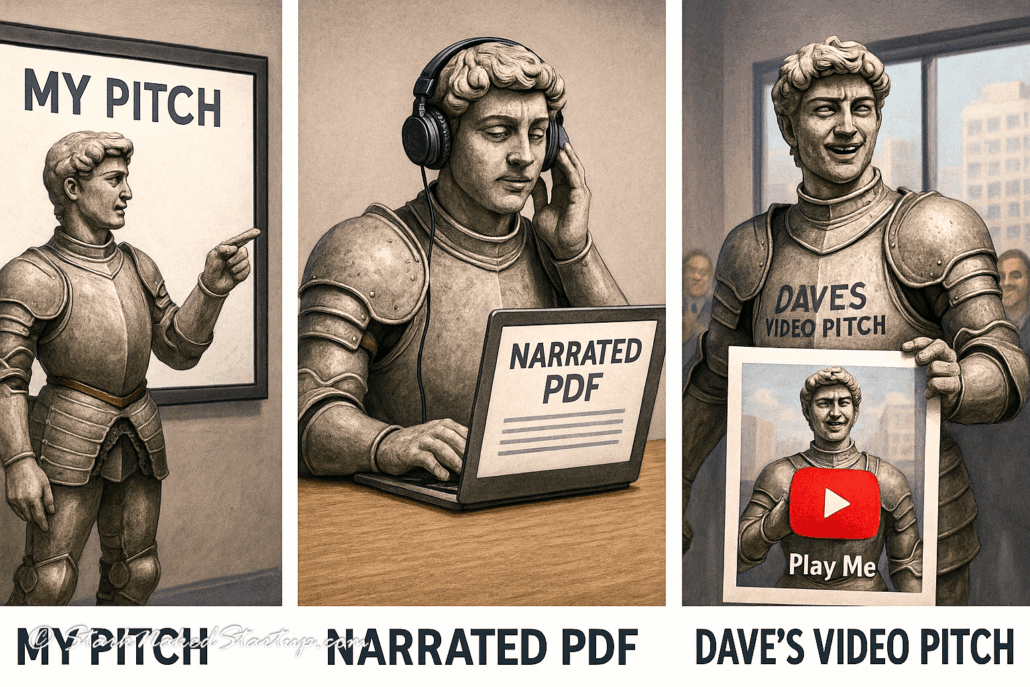

6. Pitch Deck (for live use)

Designed for what investors expect to see — not what your designer thought looked cool. Strategic, tight, and not 35 slides deep.

Your pitch deck is not a TED Talk. It’s a visual narrative that answers critical investor questions in a format that keeps them engaged, not annoyed. We help you build a deck that hits all the necessary beats: problem, solution, product, market size, traction, business model, go-to-market, team, financials, raise. Every slide has a job. No fluff. No mystery. No “we’ll get to that later.” You’ll learn how to make visuals that reinforce your message — not distract from it — and how to deliver the story in 10–12 minutes with confidence, clarity, and credibility.

7. Narrated PDF Deck (for inboxes)

What you send when you can’t be in the room. The narratio

n tells the story, so your pitch doesn’t die in someone’s inbox next to 40 others.

Most founders send silent decks into inboxes and expect miracles. Investors are busy. If your deck doesn’t talk to them, it gets ignored. A narrated PDF combines clear visuals with compelling voiceover to walk the investor through your pitch on their terms. We help you script it, structure it, and narrate it with the right energy and pacing. The result? A pitch that actually pitches even when you’re asleep.

8. Pitch Deck Video (for social/email use)

Short, powerful, and made to go where investors already are. Includes voiceover, background music, and zero weird PowerPoint transitions.

This is your pitch, but cinematic. It’s what you post on LinkedIn, send via email, or share with intros who don’t have time for a meeting. The video deck is punchy, visual, and emotionally engaging. We coach you on tone, flow, and voiceover delivery — and we design it to match your brand and polish level. Because if you want to raise capital online, you need to show up like a pro, not a PowerPoint hobbyist.

9. Private Placement Memorandum (PPM)

This is what makes your fundraising legal. Choose the wrong exemption, and you may get your check — and then have to give it back. Or worse.

If you’re raising money in the United States, you need to comply with securities law. Period. The PPM is your formal disclosure document that tells investors everything they need to know (and everything you need to disclose) to keep your raise above board. It includes your terms, risks, use of funds, cap table, financials, and SEC exemption. We help you draft it properly, tie it into your raise strategy, and ensure it aligns with Regulation D 506(c) or another compliant pathway. Because real investors expect to see this. And real lawyers look for it before they let their clients write you a check.

10. Password-Protected Investor Portal

Your startup’s digital “data room” where serious investors go to do their homework. Organized, secure, and makes you look 10x more legit.

Once your pitch lands, the investor will want to dig deeper. That’s where your investor portal comes in. We build you a secure, professional online portal where you can house your PPM, pitch materials, financials, team bios, IP documentation, customer references, and anything else that proves you’re not making this up as you go. It gives investors confidence and speeds up due diligence. And yes — we’ll even help you write the welcome message.

You’ll Learn Fluency with “Investor-Speak”

We don’t just create the documents — we train you to understand them.

You’ll learn how to answer investor questions with clarity and confidence — and finally stop being afraid of that inevitable:

“Walk me through your assumptions on your runway if your product rollout slips 90 days…”

We’ll teach you what to say, how to say it, and when to stop talking.

In other words: Investor-Speak. Fluency not required — but highly recommended.

Who This Is For (Hint: Probably You)

Startups That Aren’t Raising Yet (But Want to Survive)

Even if you’re not raising capital today, you need real financials, a plan, and a model that doesn’t rely on miracles.

We’ll help you figure out the business you actually need to build — not the one you dreamed up at 2am.

Founders Who Are Raising (Or About To Try)

If you’re already trying to raise capital without these 10 documents, you’re not pitching — you’re hoping.

We’ll make sure your raise is legal, believable, and compelling. Not just to you — to real investors.

Pricing That Actually Makes Sense

This isn’t a course. It’s not a one-size-fits-all PDF.

This is real, totally personalized help, directly with me — a 44X founder who’s raised $110 million in today’s dollars from 1,342 investors.

Most clients only need 10–50 hours total.

It’s not comprehensive — but it’s almost always transformational.

Zero long-term commitment.

Get Your Stark Naked Startup Started With a 10-Hour Retainer ($1,500)

-

Direct 1:1 collaboration

-

Strategy, documents, and investor readiness all in one

-

A fraction of what a bad CFO hire or failed raise will cost you

$1,500 is a cheap price to pay to not walk into your investor meeting wearing only a fig leaf.

WAIT! SEE LIMITED-TIME ARMOR-UP OFFER BELOW!

🎉 VERY LIMITED-TIME ARMOR-UP OFFER!

10-hour Stark Naked Startup retainer — now just $1,500.

That’s 10 hours of unfiltered, investor-grade, fig-leaf-vaporizing firepower.

🧠 Turn your fantasy financials into fundable facts

📋 Build a no-excuses Action Plan investors actually respect

🗣️ Translate startup gibberish into fluent Investor Speak

⚔️ Sharpen your raise ‘til it slices through objections

💰 And finally… stop terrifying investors with PowerPoint panic and spreadsheet hallucinations

Offer vanishes faster than a VC in due diligence.

👉 StarkNakedStartup.com

Use the below link to contact me by email –Or DM me on LinkedIn before your cap table cries itself to sleep.

Ready to Replace Your Fig Leaf With Full Battle-Ready Armor?

You’ve got the vision.

Let’s get you the documents — and the investor credibility — to match.

👉 Click here to contact us if you have any questions or you’re ready to move forward with your startup.

No more stark naked. No fluff. No excuses. No fig leaf.

PS: Want To Keep Trying to Fake It Till You Fund It?

In that case, let’s at least help you freshen up your image and improve your chances with a new, bespoke ensemble 😀 :