Need FAST Angel Investor CAPITAL For Your Startup Company or Syndication?

EASILY Deliver Your FULL PITCH DECK & VIDEO to the InBox of MANY THOUSANDS of Angel & Accredited Investors As Fast As the Next 72 Hours

Imagine If You Could Make Just One FAST ANGEL PITCH As A Pitch Deck, An Article and/or Video.

Imagine that this FAST ANGEL PITCH would immediately be delivered with your full pitch deck and video directly and warmly to the inbox of MANY THOUSANDS of Angel and Accredited Investors at a minimum – and potentially Tens of Thousands or even Hundreds of Thousands of Investors with the same one Fast Angel Pitch.

Imagine that it could all be sent and received in the next 72 hours – or faster.

Could all that be pivotally and efficiently helpful to you and your fundraising right this minute?

If so, let’s find out if your offering qualifies for my Fast Angel Pitch Service.

“Finding Your Funding Is a Numbers Game.”

I understand how difficult it is to raise Investor capital.

I personally raised over $34 million from 1,342 Angel Investors through 44 Reg D syndications for my own software, financial and real estate companies. To find those 1,342 Angel Investors, I was probably told NO by more than 20,000 other Angel Investors.

Successfully raising Investor capital for your startup company or your syndication is a numbers game.

You will need to successfully get in front of a MASSIVE number of QUALIFIED Suspects to legally end up with a sufficient number of QUALIFIED Prospects to end up with a sufficient number of QUALIFIED Investors who actually stroke the check to invest in your deal.

Firstly, Some Answers to Pivotal Questions That Both of Us Need to Know

For both of us to better understand your current fundraising needs, let me ask you a few questions that I believe will probably be very helpful for you to thoughtfully answer.

We both need clarity from these answers: so you fully understand your current situation and options – and so I can determine whether my Fast Angel Pitch Service can meaningfully help you and to find out if you qualify.

Fast Angel Pitch Service is NOT appropriate for everyone seeking Investor funding for their company.

The following straightforward, candid questions are meant to save both of us time, energy, effort and money if there’s not a solid match between your needs and my services.

These are the answers you need to know – whether we work together or not. These are the answers I need to know if and when we move forward to having a phone call after you read this web page.

What Are You Already Doing To Raise Your Investor Capital For Your Deal?

- How much are you trying to raise?

- How much of it have you already raised and deposited into the escrow account?

- What fundraising approaches have been successfully working for you so far?

- Are you happy with both the result and the speed of your fundraising efforts so far?

- What parts of your efforts could be better improved?

- What are your current roadblocks to raising your capital faster?

- How much still needs to be raised?

- How much time do you have left to successfully raise all of it?

Problems With Investor Fundraising

I have heartfelt empathy about how hard it is for startup companies and syndications to raise Investor capital. I successfully raised Investor capital all 44 times I tried for my own companies but what a gut-wrenching hassle – More often than once, just in the nick of time. I don’t know about you but that equated to a a lot of sleepless nights for me.

I quickly learned that fundraising success requires a MASSIVE amount of time, energy, effort and money. (Yes, it DEFINITELY takes money to SUCCESSFULLY raise money.)

And, there is almost ALWAYS an EXISTENTIAL DEADLINE like a TICKING TIME BOMB.

Just how short is your Runway To Extinction before you run out of cash – or how long do you have before the escrow money goes hard?

Problem – It Is Almost Always Illegal to Pay CONTINGENT Finders Fees or Success Fees

Except for some very explicit exceptions, you cannot pay a CONTINGENT finder’s fee or success fee to someone for them to connect you with Investors.

The operative word is CONTINGENT. “IF you bring me an Investor, THEN I will pay you a success fee.” This is almost always an often prosecutable violation of United States law and the laws of all 50 states.

If you don’t do this part right and the United States SEC and/or one or more state securities boards find out, you might, just maybe, have to give back all the money that you’ve raised and/or you could even possibly go to PRISON.

I’m just guessing but you very probably don’t want to go to PRISON for ANY reason.

Please check out SuccessFees.com for details and legal opinion.

Problem – WHO Is the WHO in Your Company Accountable for Raising Your Critical Capital?

If you and your company executives are going to find Suspects and convert them into Prospects and then convert them into Investors, WHO will be doing your jobs while you’re doing your own fundraising?

WHO is your company person & what credentials and direct experience do they have for successfully finding & motivating Investors to say YES and know what to do to close the sale & get the actual investment check in the bank escrow account?

If it’s against the law to pay contingent finder’s fees or success fees to motivate others to find Investors for you, how precisely are you going to QUICKLY find ENOUGH prospective Investors yourself?

Problem – Eyeballs Galore Needed

Raising Angel Investor capital requires getting your deal in front of a MASSIVE number of QUALIFIED eyeballs. Depending on your deal, don’t be surprised if it takes 500-1,000 pitches to find and close each Investor you need.

If you need 20 Investors at $100,000 each for your $2 million offering, this could take 10,000-20,000 pitches, or more, to raise all your money.

How can you legally expedite and successfully leverage your time to reach a large enough aggregate audience to raise ALL of your funding fast enough?

Exactly how do you plan on getting in front of that many QUALIFIED eyeballs QUICKLY enough to matter?

Startup Axiom of Life: If you don’t successfully raise your funding, probably the rest of everything you’ve done for your startup company won’t matter.

“You’ve got to raise every dime before you run out of time.”

Your Possible Solution – If You Qualify:

Fast Angel Pitch

Imagine making just one Fast Angel Pitch with your pitch deck, Article and/or video that would IMMEDIATELY be delivered, IN FULL, to the main inbox of THOUSANDS of INVESTORS who want additional, great investment opportunities in their deal stream.

Imagine if ALL of these THOUSANDS of INVESTORS were my personal 1st Level Connections on LinkedIn where I had an existing relationship and I was the one sending them your pitch deck on behalf of your fundraising.

Imagine if your pitch deck was sent to ALL MY 23,000+ 1st Level LinkedIn Connections + ALL 4,251 LinkedIn Subscribers to my LinkedIn Newsletter, “Startup Company Investors,” as fast as the NEXT 72 hours – Or faster.

When I press the PUBLISH BUTTON, ALL of these tens of thousands of contacts will typically have your entire pitch deck in one of their most used email inboxes WITHIN 2-4 HOURS.

Imagine your info ALSO going to maybe MANY TENS OF THOUSANDS of ADDITIONAL INVESTORS at the same time for ZERO additional cost.

How many total Investors out of all these Connections do you need to completely fund your deal?

You Want Eyeballs For Your Offering?

I’ve Got Eyeballs. The RIGHT Eyeballs.

LinkedIn has more than 930 million users worldwide – With 202 million users in the USA. Less than 1% of these 930 million users have more than 10,000 1st Level Connections.

I personally have over 23,000+ 1st Level Connections which probably puts me in the very rarefied Top 1/10 of 1% of all 930 million LinkedIn users.

Let me show you how these statistics can translate into cost-effectively helping you get your offering in front of the RIGHT eyeballs ASAP – in 72 hours or less – If you qualify.

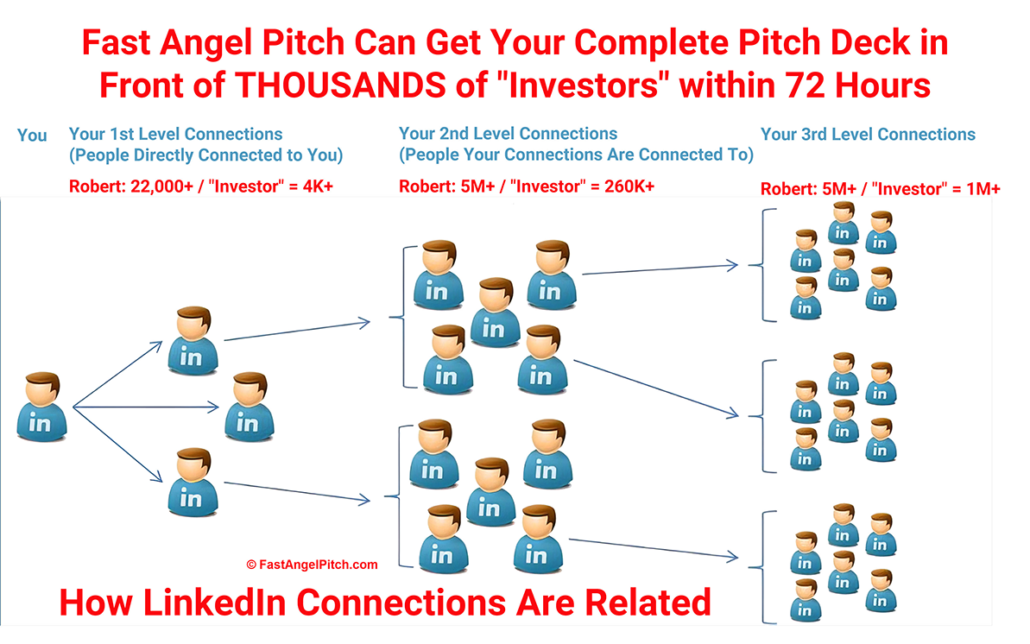

As you can see from this graphic, when I do a keyword search on the term “Investor,” I have more than 4,000+ direct 1st Level Connections that explicitly list this term in their short LinkedIn profiles.

My experiences with my 23,000+ Connections strongly indicate that substantially more of them are also Investors without specifically listing that term in their profile.

The graphic also shows that my 2nd Level Connections quickly jump to more than 5 million contacts – with more than 260,000 of those explicitly describing themselves as “Investors”.

Likewise, the graphic shows that my 3rd Level Connections include more than a WHOPPING ONE MILLION+ CONTACTS who explicitly describe themselves as “Investors.”

How many total Investors out of all these Connections do you need to completely fund your deal?

Bonus: Fast Angel Pitch Might Immediately Get Your Article and Offering on Page 1 of Google – For No Extra Cost

Note: In addition to the massive exposure from my own LinkedIn Connections, your Article in my LinkedIn Newsletter may help you IMMEDIATELY get your offering information highly ranked on Google – even on the 1st Page for certain keywords tied to your offering.

My LinkedIn Newsletter Articles offer the additional HUGE benefit that they are often quickly indexed by Google and other search engines because of the immense site authority of LinkedIn– And my own LinkedIn Profile.

This means, for certain keywords, your Article may be immediately indexed and highly ranked on Google for immense additional exposure for your offering that extends well beyond the reach of even LinkedIn.

Even though the Fast Angel Pitch Service is focused on helping companies with their fundraising, it could also be used to get your corporate brochure and links to your primary website on a highly ranked, and possibly even Front Page, on Google.

My Many Tens of Thousands Of Eyeballs Might Be The RIGHT Eyeballs For You And Your Fundraising

I was one of the early adopters of LinkedIn when I joined on August 10, 2006 – Just a few months after LinkedIn achieved its first month of profitability. (In April 2007, LinkedIn reached 10 million users.) During the past 18 years, I have slowly and methodically developed my 23K+ 1st-Level Connections specifically to primarily reach Angel Investors, accredited Investors and startup company CEOs.

I consider all of this as my Priceless, Top-Secret Intellectual Property since these 23K+ seem to represent the RIGHT eyeballs for many of the multitude of companies scrambling to raise Investor capital in this economy. As a consequence, I won’t do anything to jeopardize my Connections.

The good news is that I have developed a specialized and focused service called Fast Angel Pitch that both fully protects my direct Connections – while providing a very cost-effective, fixed-price approach for companies raising Investor capital to get their story and their pitch deck in front of a MASSIVE number of Investor eyeballs.

Solution – How I Can Help You As Fast As 72 Hours – If You Qualify

I hate seeing startup companies fail. It has always been the worst part of my consulting business for the last three decades. A large reason for so many failures is grossly ineffective fundraising by entrepreneurs.

I’ve been an active entrepreneur for the past 4.5 decades and have been working with Angel Investors for that entire time.

I probably get between 3-4 dozen requests per week on LinkedIn by entrepreneurs seeking my help to get them in front of Angel Investors for a fixed price instead of hourly consulting.

That’s why I have created Fast Angel Pitch – offering entrepreneurs a MUCH more time-efficient cost-effective fixed-price method to get their story in front of the many thousands of Investors in my network – ALL AT ONE TIME.

Fast Angel Pitch – How It Works

With Fast Angel Pitch, I publish an Article in my “Startup Company Investors” Newsletter SOLELY FOCUSED on your offering.

This Article can be a YouTube video, your pitch deck, an Article including images that are the slides of your pitch deck – OR another Article that provides supporting information to your pitch deck– OR an Article that entices prospective Investors to contact you for future investment opportunities, etc.

At the time of this update, I have 4,251 direct Subscribers to this Newsletter.

Over HALF of these Subscribers are Second or Third Level Connections on LinkedIn – GREATLY expanding my reach beyond my 23,000+ 1st Level Connections to potentially reach hundreds of thousands of self-described Investors on LinkedIn.

Here’s a Screenshot of An Article Published in My LinkedIn Newsletter, “Startup Company Investors.”

How Many “Investors” Will See The Newsletter Article That I Send Out On Your Behalf?

Your Newsletter Article will be sent to my 23,000+ 1st Level Connections PLUS sent to the 4,251 Subscribers to my Newsletter. These numbers vary but those are today’s numbers. Over 4K of this 23K self-identify as “Investors” in their own LinkedIn Profile.

Talking with many of my 23K 1st Level Connections strongly indicates that a MASSIVE number of ADDITIONAL Connections OVER AND BEYOND THOSE 4K are also “Investors” even though they don’t self-identify themselves as “Investors” directly in their LinkedIn profile.

Currently, about HALF of the 4,251 Subscribers to my Newsletter are 2nd Level and 3rd Level Connections. My 2nd Level Connections = 260K+ “Investors” and my 3rd Level Connections = 1 MILLION+ “Investors.”

HERE’S THE MAGIC: The more compelling and interesting your Article, pitch deck, video, etc., the more it will be Liked and/or Reposted to up to 1 MILLION+ ADDITIONAL “Investors”!

(It won’t be 1M+ but it could be MANY TENS OR EVEN HUNDREDS OF THOUSANDS OF ADDITIONAL PROSPECTIVE “INVESTORS” depending on how enticing your pitch deck and your deal is to these prospective Investors – AND how compelling the dozen plus #hashtags are that could greatly increase the deal views.)

What else are you doing that can deliver that many eyeballs of prospective Investors for your deal – As fast as the next 72 hours?

Check out the “Massive Additional Eyeball Impressions – No Extra Charge” section below to understand the REAL power you gain from publishing an Article with Fast Angel Pitch.

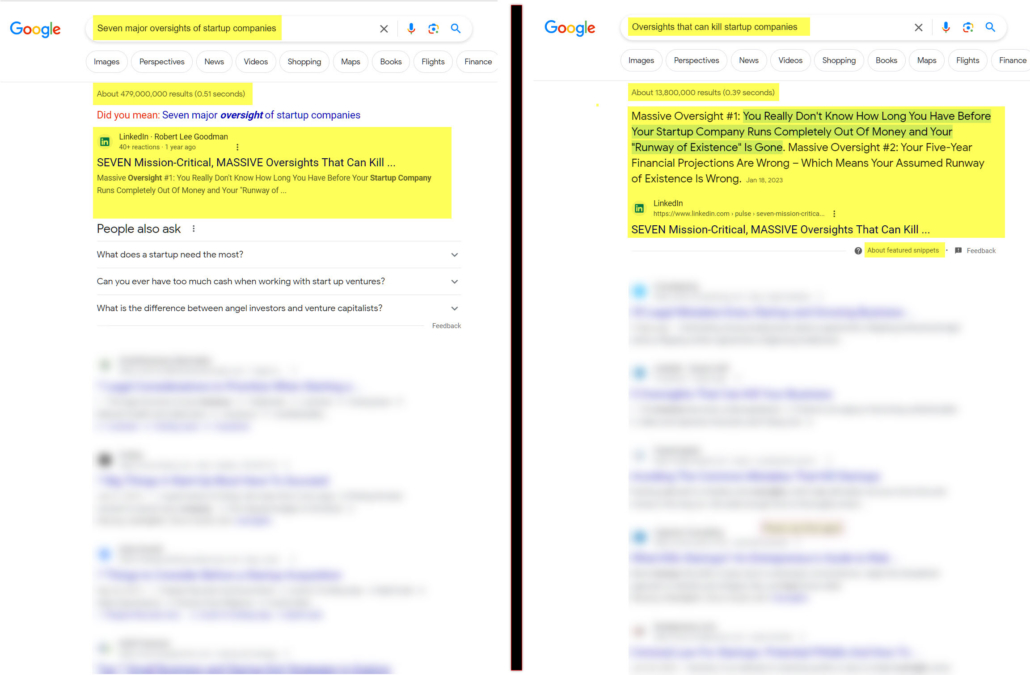

Remember When I Mentioned That You Might Get Your Fast Angel Pitch Article and Offering on Page 1 of Google?

Here are the real-life results of the sample Newsletter Article shown above about the Seven Massive Oversights. The two adjacent screen grabs show that even a year later that same Article still ranks as the #1 Search Results for the two different keyword phrases I chose. These were the #1 Search Results out of 475 Million and 13.8 Million search results respectively! As I recall, these showed up as the #1 Search Results within a day or two of publishing the Article. (Click image for the BIG picture.)

Past results are no guarantee of future results but this might be a strong indicator of just how powerful Fast Angel Pitch could be for your own Newsletter Article and its impact on your offering – Possibly getting you prospective Investors that even dwarf what you might find with your massive exposure just on LinkedIn.

Compare this amazing result from Fast Angel Pitch to the kind of Google search result struggles you may be having with your own efforts for both your website and your offering.

Also, consider the benefit to most startup companies of having any kind of top-ranking page on Google that helps tell your company’s story – especially one that might be able to withstand the SEO games of your competitors – And stay top-rated for a year or longer. All of this, for no extra charge, with Fast Angel Pitch.

Would that be worth something to you and your company?

What Happens AFTER Your Article In My Newsletter Is Published?

If your deal is ENTICING AND MOTIVATING, you should be directly contacted by prospective Investors. These contacts will use whatever email address, phone number, etc. that you include in your Newsletter Article.

This way our Connections who are Investors are FULLY PROTECTED since we never disclose their information – They control who they talk to.

However, once any prospective Investors reach out to you, the extent of that relationship between the two of you is now strictly between the two of you – Both for your current deal and any future deals.

From that point forward, we are 100% out of that direct relationship – And there is ZERO future cost to you by us from your ongoing relationship with that Connection. This is true whether you get contacted by one prospective Investor – or by 100,000 prospective Investors!

This is a GREAT way to build your own database of prospective Investors that you can reach out to at any time based on your relationship with them. Note that we have no way of knowing or tracking prospective Investors from our Connections who contact you directly. If you lose that information, we won’t be able to help you.

How many Investors reach out to contact you will depend upon a multitude of variables concerning your offering and how enticing the opportunity appears to each prospective Investor:

- Every single deal is different – And a lot of deals just are not fundable for a multitude of reasons – No matter what you do to market your deal.

- Reasons include: Your industry, market niche, traction, current revenues, management team, specific products and services, believable and achievable financial projections, your perceived ability to successfully execute your business plan, your pre-money valuation, your runway, when you reach genuine breakeven cash flow, how big you get by when, minimum offering amount, your minimum investment amount, macroeconomic considerations, geopolitical considerations, etc. – and whether the moon is full next Tuesday.

- These are just some of the factors that will either appeal or be a turnoff to each prospective Investor.

- Even if you hire us, DO NOT solely depend on our Fast Angel Pitch Service. Aggressively pursue ALL avenues for fundraising until you have reached your goal! Whether you work with us or not, never slow down the aggressive marketing of your fundraising one iota until ALL of the money is raised from every possible source and actually deposited in the bank’s escrow account for the deal! Treat this as an Axiom Of Life!

- If you’ve done a poor job at designing your offering, your deal may not be doable by anybody – No matter what.

Because we can’t control any of the above, including whether the moon is full next Tuesday, we can’t guarantee you any results of any kind.

If you receive very few contacts – or none whatsoever, we strongly recommend a hard, objective analysis of your offering to make it more enticing.

We offer an optional service for this specific help – both before sending the Newsletter or afterward. It makes a whole lot more sense to get help crafting your offering and message BEFORE sending the Newsletter.

We want to see you rip-roaring successful with our Fast Angel Pitch Service where you are, hopefully, OVERWHELMED by responses from prospective Investors. I strongly recommend you take advantage of our optional service BEFORE we publish your Article so that your pitch deck has the best impact possible to motivate prospective Investors to contact you to invest in your offering.

Fast Angel Pitch: The 7-Step Process

-

Does your offering qualify for Fast Angel Pitch?

-

Provide us with your Article, pitch deck, video, etc. that you want to be published.

-

We review your proposed Article and decide if it’s appropriate for our Newsletter and our 1st Level LinkedIn Connections.

-

If you are approved, you secure your spot by making payment in full and we schedule your publication subject to the appropriate Queue.

-

You review the Newsletter Article before publication.

-

Your Newsletter Article is placed in your chosen Queue and published.

-

You are contacted directly by any interested prospective Investors.

Do You Qualify For Our Fast Angel Pitch Service?

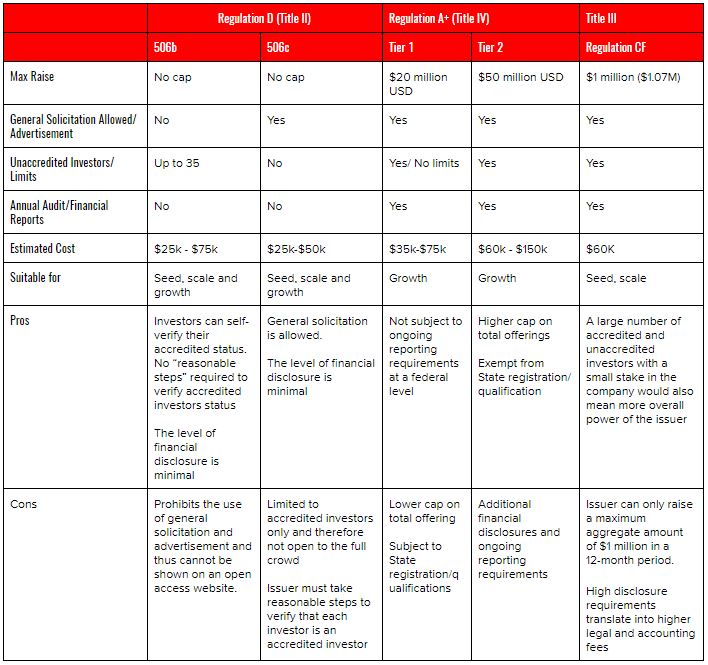

Your offering must be structured so that it is SEC-compliant for public solicitation of Investors. You and your securities attorney are SOLELY responsible for verifying this issue PRIOR to the use of our Fast Angel Pitch Service.

This service is generally geared toward Reg D 506(c), Reg A+, Reg CF, etc. – but NOT offerings, for example like Reg D 506(b), which do not allow for general solicitation. Lastly, I will need to approve your offering and your solicitation material to help ensure that it’s appropriate and would be of interest to my Connections. I reserve the right, in my sole discretion, to reject any prospective Client for this Service for any reason.

Lastly, I will need to approve your offering and your solicitation material to help ensure that it’s appropriate and would be of interest to my Connections. I reserve the right, in my sole discretion, to reject any prospective Client for this Service for any reason.

Review, Decision and Queue

We will promptly review the information provided, deciding on whether your deal qualifies.

Simultaneously, we’ll discuss potential timeslots for your Newsletter Article – Depending on the level of service you need based on your urgency. Our Fast Angel Pitch Service is provided on a FIRST-IN / FIRST-OUT basis (FIFO.)

- You reserve your place in line with your non-refundable payment.

- For example, if five clients have paid earlier, their Articles gets published in the order in which they made their nonrefundable payments.

- Our current expectation is to only publish a maximum of between 1-2 of these Fast Angel Pitch Articles in our LinkedIn Newsletter each week so that we don’t SPAM our Connections.

The FIFO Queue For Fast Angel Pitch

Using the above example of five clients already in the Standard Service Queue when you make your payment would typically translate to 2.5 weeks to 5 weeks lead time before your Article will be published.

Alternatively, you can tap either our Priority Service or our Top Priority Service which is priced, respectively, at a 50% or 100% premium over Standard Service. Both Priority Service and Top Priority Service have their separate Priority and Top Priority Service Queue which should translate to your Newsletter Article being published much more quickly than the Clients in the Standard Service Queues.

Note: ALL Top Priority Queue Clients have their Articles published before ANY clients in the Standard Service Queue or Priority Service Queue and ALL Priority Queue Clients have their Articles published before ANY clients in the Standard Service Queue.

Note: If you have made your nonrefundable payment, you immediately receive a place in the appropriate Queue. However, if your Article is not ready for publication because of changes, additions, etc. to your Article, other Client Articles in all Queues will be moved ahead of you in the Queue until you are ready for publication. The good news is that when you are ready for publication, your Article will be the next published Article in your Queue.

If you prefer to make all of your changes before making the nonrefundable payment, your Article will be placed at the back of whichever Queue you’ve chosen once your Article is ready for publication.

Introductory Pricing: 50% Discount for Standard Service – Very Limited Time Only

Suppose your deal qualifies and you wish to proceed. In that case, we sign the Statement of Work Agreement and you make a nonrefundable payment in full for one of the following Services (these prices already include the very limited-time 50% introductory discount for Standard Service.)

- Standard Service, for an approximate 20-Business-Day Turnaround, is only $4,950. Standard Service is specifically designed to help those Clients when money is much more important than time – but they still desire to have the same kind of massive exposure to the same Investor base.

- Priority Service, for an approximate 8-Business-Day Turnaround, is $14,850. Priority Service is specifically designed for those Clients desiring a balance between the importance of time and money.

- Top Priority Service, for an approximate 72-Hour Turnaround, is $19,800. Top Priority Service is specifically designed for those Clients where time is of the essence and the clock is ticking to find prospective Investors as fast as possible.

The price of Standard Service at $4,950 is estimated at ONLY 18 Cents for each delivery of your Pitch Deck Article that is directly emailed, in full, from me to every one of my 1st Level Connections and every one of my subscribers to my “Startup Company Investors” LinkedIn Newsletter.

Your payment purchases one of the above Services. All services include publishing your one Article, one-time, in my “STARTUP COMPANY INVESTORS” LinkedIn Newsletter that is automatically sent ONCE to my 23,000+ 1st Level Connections on LinkedIn AND ALL 4,300 Subscribers to that Newsletter (These numbers are constantly changing. You can always check my current LinkedIn Profile to see what this number is at any given time.)

(Note: Each of the above turnaround times are estimates only and may be longer depending upon the size of the respective Service Queues.)

Massive Additional Eyeball Impressions – No Extra Charge

Top Priority Service also includes my crafting LinkedIn Newsfeed Posts that include a link to your Newsletter Article eight additional times during the four weeks following the publication of the Article. (Priority Service includes four additional times and Standard Service includes two additional times.)

These LinkedIn Posts will show up in both the LinkedIn Newsfeed to all 23,000+ 1st Level Connections and also in their LinkedIn Notifications.

Based on the current numbers, EACH of these LinkedIn Newsfeed Posts AND Notifications represents an additional, WHOPPING 50,251 POTENTIAL IMPRESSIONS on LinkedIn of a pitch that describes your Article and includes a link to your Article – giving you additional opportunities to capture previously missed prospective Investor eyeballs for your deal– OR a reminder to previously interested prospective Investors that they need to mainly reach out and make contact with you.

This translates to 402,008 additional potential impressions for Top Priority Service Clients. (201,004 for Priority Service and 50,251 for Standard Service.)

Because all of these additional posts also include over a dozen applicable hashtags, a multitude of other 2nd-Level and 3rd-Level Connections may see these posts for your offering and contact you directly.

LIKES, SHARES, COMMENTS on any of these could have a huge impact on SIGNIFICANTLY increasing even these whopping numbers.

What Happens After You Successfully Raise All Of Your Funding?

- What happens IMMEDIATELY next as soon as you have raised ALL of your funding?

- R&D? Hiring personnel? Increased advertising? Cover operating costs to increase runway? Something else?

- What does the company look like at the end of Year Five after successfully raising your current funding goal?

- In five years, what are your annual revenues? Profits? Company valuation?

- What are those Year Five answers if you DON’T successfully raise ALL of your current fundraising?

What Are The Current Consequences Of Failure?

- What happens if you don’t raise all your Investor capital by your deadline?

- Can you continue successfully moving forward without investment capital?

- What, organizationally, is most negatively impacted without the infusion of new capital?

- What happens to your company’s runway – the number of months from now before your company completely runs out of money – without the Investor capital you are trying to raise with your current fundraising efforts?

- Without this funding, what happens to your company? Your employees? Your vision?

Which Is More Risky for You and Your Company at This Point?

- Is it more risky to use our Fast Angel Pitch Service that might get your pitch deck in front of THOUSANDS OR TENS OF THOUSANDS of new prospective Angel and accredited Investors as fast as the next 72 hours?

- Or, is it more risky to continue doing what you have been doing with the hope that you are going to be able to actually find enough suspects, convert a certain percentage of those into prospects and then convert even a smaller percentage of those into Investors who might actually stroke the check?

- Is it more risky, by using your current methods, that your current offering will fail – which means you have to return all the money you’ve already collected – and you won’t have the money to do any of the things you identified that would only happen with successful fundraising?

Optional Services For Fast Angel Pitch

Hourly Consulting

Suppose you, optionally, would like my help with any part of your fundraising such as your offering structure, pricing, proofreading, and financial projections review, Investor relations – along with help writing or editing your Fast Angel Pitch Newsletter Article, etc.. In that case, I will be glad to help. My goal is to do what I can to help my Fast Angel Pitch Clients be rip-roaringly successful with their fundraising.

After 4.5 decades of working with Angel Investors – and over three decades helping thousands of startup companies, I have learned nuances galore that might, just maybe, make a pivotal, positive impact on your Article in my “Startup Company Investor(Standard Service)s Newsletter.”

My hourly rate is $250 per hour and I require a $2,500 nonrefundable retainer for 10 hours of my services.

Optional Services For Fast Angel Pitch

Due Diligence Review of Your Offering

Every time I publish a Fast Angel Pitch Article In my Startup Company Investors Newsletter, I will include a preface that will have similar wording to the following:

“This looks like an interesting investment opportunity for your deal stream. I’ve not done any due diligence myself but wanted to expedite sharing the opportunity with you. As with all opportunities, be sure and perform your own detailed and comprehensive due diligence before you decide to move forward with investing in this particular venture.”

Note that the above does not include any endorsement or recommendation of the offering.

If you would, optionally, like to have my full endorsement and/or recommend your offering when you post your guest-authored Article. I can’t do that unless I’ve done a deep dive through your offering documents, your business plan, your detailed five-year financial projections, etc.

If you would like for me to do this deep dive with the non-guaranteed goal of my endorsing and recommending your offering as a preamble to your guest Article, the nonrefundable, prepaid, fixed fee for this optional service is $6,250.

Note: Payment of this fee and my completion of this Due Diligence does NOT mean that I will reach the conclusions you want me to reach. Even after the deep dive, I may not be able to endorse or recommend your offering to my 1st Level Connections if i have concerns or reservations with your documentation, financial projections, etc.

Very Limited Number of Slots Available per Year

My primary goal is to protect my 1st Level Connections from spam, scams, shams, charlatans and clutter in their email inboxes. My other priority is to do all I can to help qualified Fast Angel Pitch Clients enjoy rapid rip-roaring success grabbing the attention of prospective Investors as a result of this service.

Because of this, we currently intend to limit the number of Fast Angel Pitches to no more than once per week – or about four finalized Newsletters per month for Standard Service. Likewise, we intend to have a maximum of two finalized Newsletters per week for Priority Service and three finalized Newsletters per week for Top Priority Service.

If, for example, there are three other Standard Service Clients in the Standard Service Queue ahead of you, it may take a month to send your Newsletter.

If your urgency is paramount, we recommend using our Top Priority Service where we try to send one finalized Top Priority Newsletter every 72 hours (three business days) depending on the size of the Top Priority Service Queue.

Secure Your Spot For Fast Angel Pitch Today

Questions or Ready to Move Forward with Massive Actions?

If you believe that you are genuinely QUALIFIED and are interested in benefiting from my Fast Angel Pitch Service in the immediate future, let’s talk.

Please contact me by clicking Contact Form and we can set up a mutually convenient phone call or Zoom conference. On the Form, please give me some specifics about your current offering so that our call can be more productive.

On the Form, please give me some specifics about your current offering so that our call can be more productive.

- How much are you trying to raise through what SEC type of offering?

- How much of your offering have you already raised and deposited into the escrow account?

- What fundraising approach has been successfully working for you so far?

- Are you happy with both the results and the speed of your fundraising efforts so far?

- What parts of your fundraising efforts could be better improved?

- What are your current roadblocks to raising your capital faster?

- How much still needs to be raised and how much time do you have left to successfully raise all of it?

Your answers to these questions will help me determine whether my Fast Angel Pitch Service is really your best option given your current fundraising status.

Whether we work together or not, I wish you spectacular, stellar success with your fundraising!

Robert Lee Goodman, MBA

CEO & Chief ImpleMentor

CEO RESOURCE LLC

My 23K+ 1st Level Connection LinkedIn Profile: Linkedin.com/in/robertleegoodman

Elevator Pitch: “I Help Startups Start and Stay Started With My Services – And My Network Of Angel Investors.”

PS:

——————————

SEVEN Mission-Critical, MASSIVE Oversights That Can Kill ANY Chance for Angel Investor or Venture Capital Funding for Your Startup Company. Please click the following link for a recent Article in my LinkedIn Newsletter:

https://www.linkedin.com/pulse/seven-mission-critical-massive-oversights-can-kill-any-goodman/

——————————

PPS: For the past 30 years, I have focused solely on helping startup and emerging companies with their business planning, fundraising, implementation and mentoring of the CEO and other senior executives. During that time, I’ve already directly helped THOUSANDS of diverse startup companies and their CEOs, in 49 of the 50 states, in more than 70 countries, on six of the seven continents and in more than 200 different industries.

PPPS: Prior clients have to say about me and my services: Chiefimplementor.com/testimonials

LEGALESE ALERT: NOTICE & DISCLAIMERS

LEGALESE AND POWDERED WIG ON

Why There Has To Be Absolutely No Guarantees Whatsoever With Any of Our Services Including Fast Angel Pitch Service

- Every single deal is different – And a lot of deals just are not fundable for a multitude of reasons – No matter what you do to market your deal.

- If you’ve done a poor job at designing your offering, your deal may not be doable by anybody – No matter what.

- Reasons include: Your industry, market niche, traction, current revenues, management team, specific products and services, believable and achievable financial projections, your perceived ability to successfully execute your business plan, your pre-money valuation, your runway, when you reach genuine breakeven cash flow, how big you get by when, minimum offering amount, your minimum investment amount, macroeconomic considerations, geopolitical considerations, etc. – and whether the moon is full next Tuesday.

- These are just some of the factors that will either appeal or be a turnoff to each prospective Investor.

- Absolutely do NOT solely depend on our Fast Angel Pitch Service. Aggressively pursue ALL avenues for fundraising until you have reached your goal! Whether you work with us or not, never slow down the aggressive marketing of your fundraising one iota until ALL of the money is raised from every possible source and those funds are actually deposited in the bank’s escrow account for the deal! Treat this as an Axiom Of Life!

Because we can’t control any of the above, including whether the moon is full next Tuesday, we can’t guarantee you any results of any kind.

ERGO: THERE IS ABSOLUTELY NO GUARANTEE AND NO WARRANTY OF ANY KIND WHATSOEVER FOR ANY OF OUR SERVICES INCLUDING FAST ANGEL PITCH.

NOTA BENE: IF SOMEONE IS GUARANTEEING YOU FUNDRAISING RESULTS, BEWARE OF CHARLATANS AND SCAMS!

Note: All prices and terms are subject to change without notice and are subject to Robert’s time availability. If you hire us, you work with Robert – not some inexperienced subordinate who lacks his 4.5 decades of experience. Since there is only one Robert and he limits the number of active clients he works with at any one time, he will not always be available to work with new clients. We strongly recommend signing up for our Chief ImpleMentor Service or our Fast Angel Pitch Service at your earliest convenience since Robert may not be available to new clients at a moment’s notice to help you with your company’s critical needs.

Client understands that any, and all Services to be performed by CEO RESOURCE LLC (“CEOR”) are to be strictly performed by CEOR without limit on a “best efforts” basis and are not, in any manner, to be construed as CEOR giving Client either tax, accounting or legal advice; (b) Client warrants that it is not a partner, agent, officer, director or employee of, or Investor in, CEOR, by Client’s purchase of Services. Client acknowledges that any and all private placement and fundraising services are exclusive of any state and federal filings or state blue sky research. Additional hours of Management Consulting shall be billed at the then prevailing rate. There is no assurance, whatsoever, that any private placement, or other offering, services developed for or provided to any company or any and all fundraising services by CEOR will be successful in whole or in part. As such, absolutely no warranty or guarantee is expressed or implied whatsoever for any services provided by CEOR and any and all payments made are strictly nonrefundable for any reason.

CEOR gives neither legal nor tax advice – ONLY business advice and consulting. Preparation of the draft of any Reg D documents and/or private placement memoranda and related documents by CEOR is to ONLY facilitate documents that will cover relevant business points on a “best efforts” basis. Since there is no assurance, whatsoever, that any private placement, or other offering, documents developed for Client or fundraising services provided by CEOR will be fully compliant with either federal or various state regulations, Client agrees to have their own attorney and tax advisors review, and modify, any and all documents completed by CEOR to ensure that any and all documents meet all local, state and federal laws PRIOR to using these documents to raise funding. Visit ChiefimpleMentor.com for additional notices and disclaimers.

Any included images, video and the like are included here under Fair Use. Copyright Disclaimer Under Section 107 of the Copyright Act of 1976; Allowance is made for ‘Fair Use” for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use. All rights and credit go directly to their rightful owners. No copyright infringement intended.

LEGALESE AND POWDERED WIG OFF

© 1994-2024 CEO RESOURCE LLC. All rights reserved for the content of this document and presentation.